Hi Vivek,

Nice piece on Superhuman. Have to admit, didn’t know about Superhuman before this. Well, Indian markets found its very own Superman this week, the RBI. Read on.

Last couple of weeks have seen a lot of news coverage on India’s economy. It started with more analysis pouring in that Indian economy is doomed. Then came some announcements from the Union Government, similar to the ones mentioned in my previous post, which were well received by the market. Then the news of RBI transferring a record Rs. 1.76 trillion to the union government, news Zenith, couldn’t get better? Doesn’t stop here though, FDI norms for a few sectors were relaxed in an effort to improve Foreign Direct Investment in the country. Then came in the annual results of RBI, a staggering 146.5% increase to its surplus to Rs. 1.23 trillion. The markets rallied after the measures announced by the government. But the markets corrected subsequently and are back to almost the same level they were last week. Then just yesterday came the news of GDP growth rate slowing to a 6 year low of5%. And the news of consolidation of 10 public sector banks to 4. Phew! The funny thing about business news is that they have near-term cycles while the subject they cover(businesses), have long-term cycles.

For this post, I want to delve into the news that came out of RBI. Lets start with RBI’s annual results.

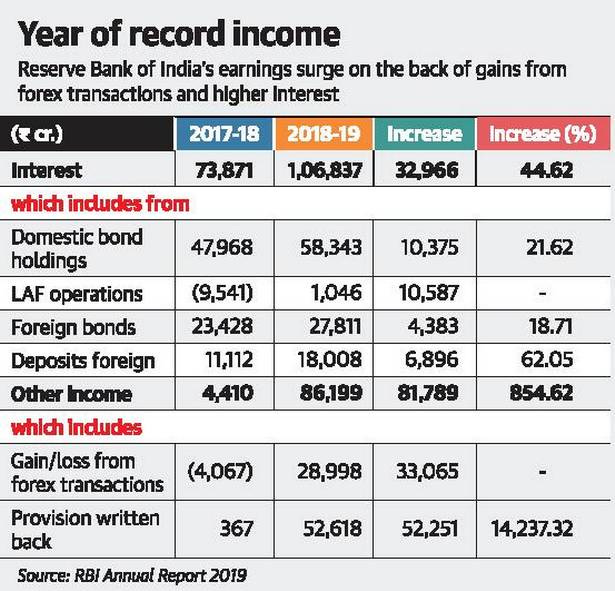

Source: https://bit.ly/2HB02v4

Let us look at the major reasons for this huge spike in the net income of RBI.

Liquidity Adjustment Facility (LAF)

Operations is one of the major contributors to the increase of income. This is the income for RBI on the interest earned by it on the short -term borrowing of banks( this income is the net of the repo and reverse repo earned/ paid to the RBI).

Domestic Bond holdings part captures the interest the RBI has earned on the Bonds it bought back from the market. This increase indicated a huge amount of buying of bonds by the RBI in an effort in increase liquidity. These two are in expected lines given that RBI has been trying to increase liquidity and boost demand by cutting interest rates.

The problem arises in the Other income part of the RBI’s P&L. A whopping Rs. 33,065 Crore increase in the forex transactions of which over 21000 crore was due to a change in the accounting methods. Let me break it down. According to earlier accounting practice, the gains/loss were calculated by comapring the buy/sell price with a weekly revaluation rate of that currency. Now, it has moved to a weighed average price.

Let me explain, assuming the RBI has bought currency at different exchange rates of say 50, 55, 60 , 70 etc and the weighed average of this price is say 55. Say the current exchange rate for US Dollars in 72. Let the weekly revaluation rate(for previous week) for US dollars be 70. For each dollar sold in by the old method, the RBI would have earned Rs. 2. Now, in the new method, for each dollar sold, the RBI earns Rs.17!

The problem I have with this is that these dollars that RBI has bought at various price points, which have enables a lower weighed average price, were bought historically, since 1991, not just in this year. And so, the RBI will show unduly high income ( which it will transfer to the govt) in these times when the rupee is weak. The RBI purchases the dollars and then sells them in an effort to bring more stability in times of high volatility in the exchange rate. It is not in the business of making money buy realising gains on the dollars held. The earlier method, which compares prices only to the previous week’s revaluation rate ensured unduly high gains were not possible to be recognised. But this new method leaves room for misuse. Consider the following said by Prof. Anant Narayan of SPJIMR.

“I am sure the RBI has thought of checks and balances to ensure it doesn’t happen but you could have a situation where a weaker rupee helps recognise more P&L gains and the RBI starts to recognise those higher rates. Second, even buying and selling with a net impact of zero can help the RBI recognise P&L.”

Hence, this sudden change to a more aggressive accounting from the traditional conservative method is worrisome. It somehow shows that the RBI wants to show a higher income so that it could transfer the surplus to the government. I understand that it works both ways, in the sense when the weighed avg price is higher than the current market price, RBI will show losses. But the RBI seems to be thinking short term here.

Another item in ‘Other Income’ which has shown a huge jump is ‘Provision written back’. Now, this needs a back story to explain further.

Bimal Jalan Committee

This committee was formed in November 2018 to come up with an economic capital framework. Earlier, the board of the RBI used its discretion in deciding how much of the surplus income is to be transferred to the union government. This committee was tasked with formalising the process within a framework.

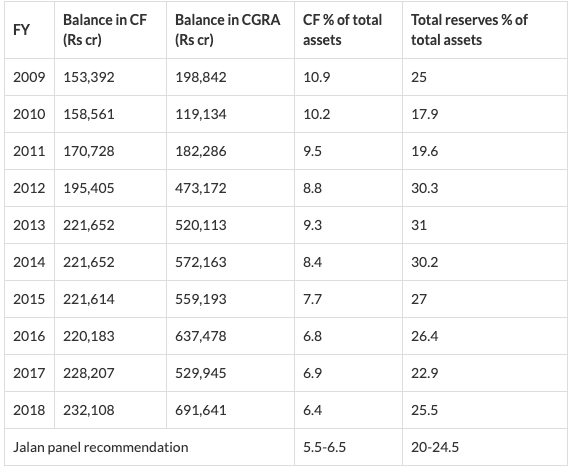

Among its other suggestions, the committee suggests the RBI to keep 5.5-6.5% the RBI balance sheet in the Consolidated Fund while disbursing the rest to the Union Government. It left it to the board of RBI to decide the exact percentage. The Board of RBI, whicle accepting the recommendations, decided to choose the lower limit of 5.5% of the balance sheet’s size.

Source: https://bit.ly/2Lauv5g

As the table above indicates, the balance in CF was at 6.4% for 2018. Note again that the Jalan committee has set a range of upto 6.5%. But the board chose the lower end of the range (5.5%).To bring it down to 5.5% from 6.4% means to disburse an additional Rs. 52618 crores. This is shown in the “provisions held back” section of the P&L. Add to this the entire surplus of 1.23 lakh crore for this year. Thats how we arrive at the 1.76 Lakh crore that is being transferred to the centre. The change in the accounting of the forex and the “provision held back” together account for over 40% of the funds transferred to government.

A look at the CF% of total assets of previous years shows that the Contingent Risk Buffer will be much lower than what it was in at least the last nine years. 2009 was a recession year and the RBI is seen to have held up much of its surplus to nurse the economy to health if needed. We are now again experiencing a global trade turmoil and the RBI’s annual report itself indicate a slowdown. But the RBI is being aggressive in opting for a lower buffer.

Also, the RBI which is primarily mandated with controlling inflation, has its governor talk of boosting growth very often. Banking health and the ongoing hardline on NPA must remain the primary focus of the RBI. Admitted that the economy needs stimulus while the Government tries to not extend it fiscal deficit beyond 3.3 % of the GDP. But the Government looking at RBI for funds and the RBI responding with zest makes for some poor optics and precedence. Making short term concessions which can have long term ramifications, shows a new RBI. One which is myopic, closer to New Delhi than before thereby signalling weakened independence. There cannot only be cheerleaders in a match, impartial umpires who know the rules are needed too.

Regards,

Bheem

Disclaimer: All the views expressed above belong solely to the author, and do not represent those of the organization he works in.

Duologue is an effort by Vivek and Bheem to have a dialogue about varying topics.

If you liked what you read, you can subscribe to our newsletter.

Share it around if you find any of this piqued your interest or might be interesting for your peers.